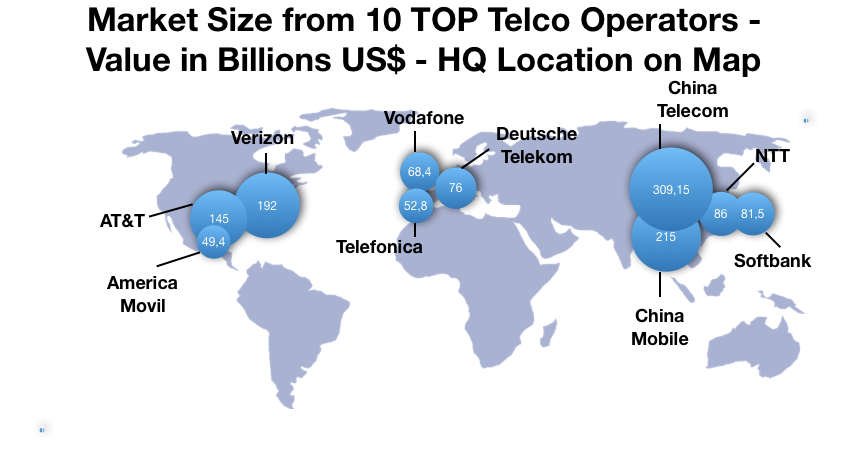

Top 10 Telcos (by MARKET CAP) and Telcos Future Plans

The chart below was compiled with data from the “Investopedia” website. This is the market value of the 10 largest Telecom operators.

Data Table:

We can see that there is a distribution on the European continents in North America and Asia, which is naturally related to the developed world. We also see that these companies are global. That is, they have branches scattered in other regions of the planet, but their headquarters are in that map location.

But the idea here is to talk about the operators’ strategy for the coming new decade. The world really changing as all talk and is reflected in all the opinion makers; suppliers of technology; and of course in the operators themselves.

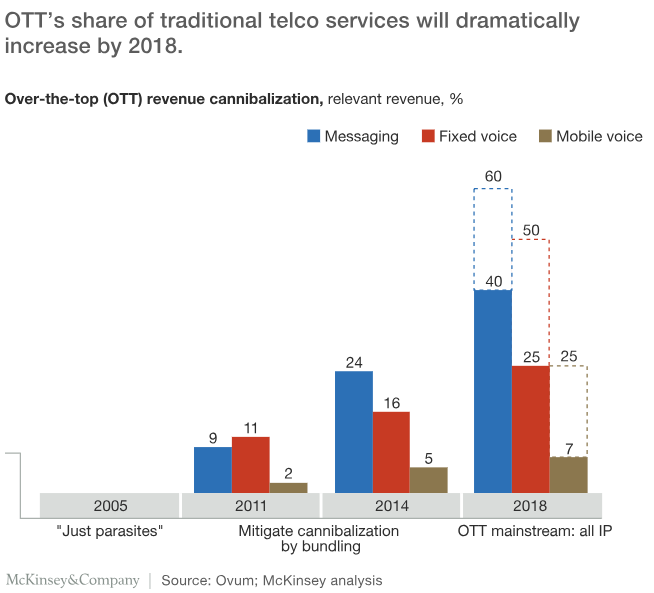

First, technological change is not always in tune with the ups and downs of the economy. And often companies have to face competitors of the same type ie other operators. However, they suffer threats from a different category, as has been happening in recent years, ie over-the-top companies such as Google and Amazon, for example.

All these companies have customers all over the planet. This means that they are in different degrees of maturity. So, it is an opportunity is important to merge this type of action bringing the transformation into developed markets and introducing what strategies worked fine, little by little in other markets.

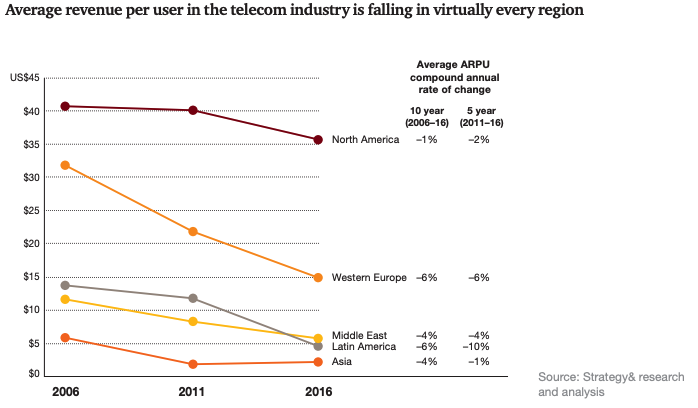

One of the ways to test the competition threat is to monitor how the “Voice” category consumption has declined in every region for any operator. It means, to check how the revenue per subscriber has dropped. In this case, this means that there has been a smooth migration to services to “Data” made available on the internet.

Check this fact below, with this chart from PwC Telecommunications Trends Report.

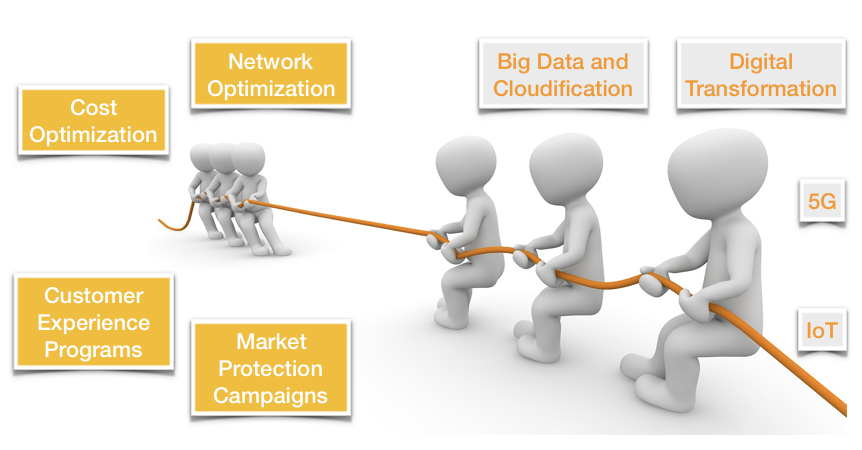

This has divided the focus of investment year after year from each of the operators and how to survive in this jungle. Acquiring other companies? Extend their market? Control costs and consolidate lean and efficient operation? Or bet deep in the innovation in technology with the digital transformation?

On the one hand they are betting on doing better what was already done well. For example with Customer Experience programs; avoid churn; carry out brand improvement campaigns, etc.

But as they say, you need one eye on the fish and another on the cat. With the threat of OTTs as we have seen, it is necessary to bet on new technologies such as 5G, the Internet of Things and the use of Big Data and Cloudification.

These are technologies that I will not go into detail here but are part of a digital transformation.

It is necessary in this mix to face the threats of Service Companies, the operator cannot–at least for the big ones–be only a Net Company to stay in the market. Acting at this level, with this volume, they need much more.

Still the OTT Threat

Check out this McKinsey chart as OTT grew up in the Telcos “market”.

Well, in the United States alone, there has been a 50% decline in mobile call duration recently and this downward trend will not change.

Today, 63% of the world’s population is connected to mobile devices. We have 4.7 billion unique mobile subscribers in the world. By 2020, today’s fast-growing markets such as China and Brazil will have reached a similar level of saturation seen today in most mature markets. Digitization will increase the number of connected devices from 18 billion to 50 billion by 2020, and to hundreds of billions of connections in the next decade.

The Telco Tug of War

That is what I try to show in the chart below, an internal tug of war to be fought … how much to invest in each side?

However, in the face of limited resources, it is necessary to know how to invest in research and development in the new and where to insure efficiency in optimization and costs.

Of course, all these big companies have programs on both sides. But according to the training of researchers, the focus, and the partnerships made, will be more or less successful in each initiative.

For example, we can imagine one of the 10 largest Telcos in partnership with a major one, establishing regional partnerships by continent. Another partnership with an automaker (also global), and software companies to build a consistent Connected Car platform. To complete, one OTT could come in to boost sales and integration.

The important thing is to be on the wave of transformation in a prominent position, not waiting to be “commoditized”.

Today, we find a vast collection of innovations by technologies. We understand that it is impossible for only one operator to firmly embrace ALL innovations with competitive programs in all segments. However, choices have to be made. Standing still will be fatal, the important thing is to choose who are the talents within the company, so that certain innovative projects succeed, and establish good alliances. Choose an ideal market and be consistent with a well-structured enterprise program with a investment line standing out around the world as a benchmark.

We could cite only as program examples: A connected car project; Smart Homes; of Smart Cities; IoT; Agribusiness… all of them are interesting. Telcos have to make choices and go where stabilization in future operations is glimpsed while maintaining high competitive technology.