The Blockchains War

It was not yet approaching 2140, but the virtual currency Bitcoin remained at reasonable levels for investors. The world economy still suffered from the old ups and downs in almost every country, but a lot had changed.

The financial market had lost much of its power, and a milestone for this was precisely the conjunction of financial crises and the combination of the main virtual technology, that is, the blockchain at its operational core.

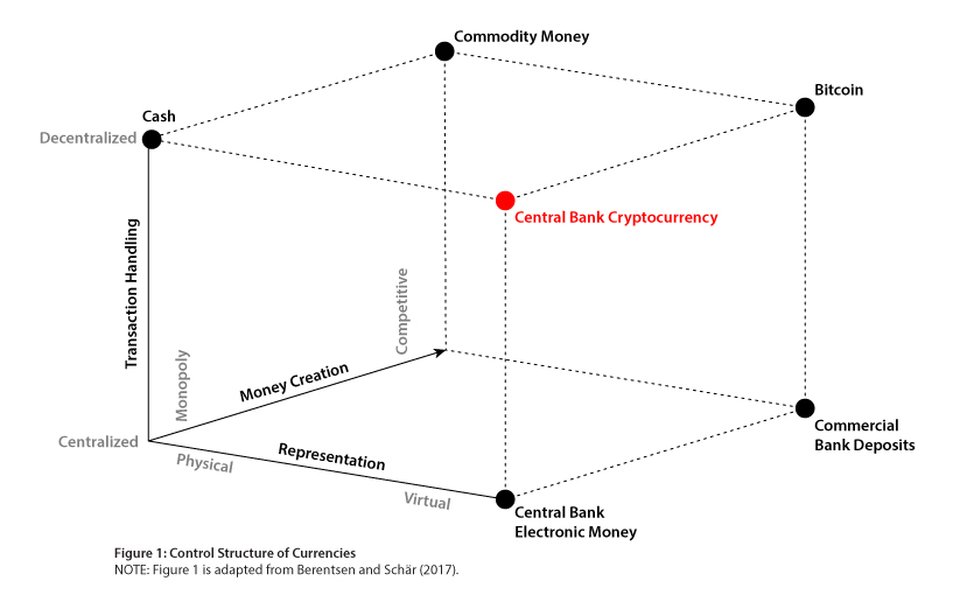

After a boom in growth and several waves of globalization, financial organizations were realizing that they absorbed much of what they criticized in pioneering cryptocurrency like Bitcoin—which was precisely the loss of control over the use of money, their purposes, their resources.

Even with new regulation was created long ago, it aimed at inhibiting money laundering and illicit hidden transactions, the “official” blockchain became so powerful that it broke through national barriers, where central banks imposed more vigorously regulation and gradually allowed, again, parallel transactions, money laundering and drug dealer operations. Now however, by much more complex mechanisms, and oriented in some way by the very extent of the blockchains. The financial market got richer still, everyone was globalized to the extreme, but now a new financial crisis was approaching.

At the same time, it was necessary to recognize that more developed countries improved their preventive actions in the area of illicit operations, drug trade and money laundering, but this was due more to the evolution of the education sectors and of the income itself than a rise in the level financial operations as a whole.

Sectors, regions, communities still flirted with the illegal however, and captivated a sturdy parcel across the planet with illicit operations and consumption.

Even with regulation, operations varied natures were distributed in “all” blockchains and a short time ago no one was counting that a greater threat would now occur in official cryptocurrency, in theory more protected with regulations.

It turns out that the ballast of operations, the technical reserves of financial entities operating on the licensed blockchains were also thinning globally and a control closely scrutinized by the central banks also loosened. It was found bitterly that all the blockchains allowed the same degree of money laundering at a later stage.

Worse now, the axis of control of the official blockchains has shifted from more restrictive regions and has been partly in the hands of speculator groups, manipulators via large-scale operations, who have gradually destabilized the official cryptocurrency. There was thus a group of account holders who were now returning to the original cryptocurrency, which formerly suffered the nickname of “parallels”. The cast in stone thesis of a totally decentralized blockchain, still inhabiting the miners, eventually offered an option as safe (or unsafe) as the establishment versions.

Romantic remnants of bitcoin’s history seized the moment to claim that the true transformation was there in the original proposal, and they recalled how much history punished, condemned pioneers, and stalled companies and initiatives of the early Bitcoin era.

If someone thought for a moment of a coordinated migration from the official cryptocurrency to the originals, it became unnecessary. Companies, ordinary people, public bodies were migrating on their own, and national regulations were then greatly relaxed to allow for a smooth transformation. It was the way out of a global financial crisis.

In favor, there was at that moment a poignant economy, a greater degree of confidence in the already consolidated bitcoin, and a naturalness of people in dealing with the subject, a lesser resistance indeed. The cryptocurrency and the block-chain had penetrated every social and technical culture, and did not reserve so many surprises. The world knew that now, the battle against illegalities should deepen in its origin, acting at the base of societies and further away from the financial world. This was due to the virtual currencies in their original context.

The society would then finally pay its tribute, letting the flow of money migrate to the distributed and self-regulated blockchains.

.